Savings and Sinking Funds Spreadsheets: Your Blueprint to Financial Security

Managing money can sometimes feel like chasing unicorns, we're all on a quest to crack the code to financial stability, but sometimes it’s hard to figure out what to actually do.

Imagine this: you've got your eye on that epic summer road trip with your family, but you've also got bills and responsibilities to juggle.

That's where these Savings and Sinking Funds Spreadsheets swoop in to save the day!

They're not just fancy spreadsheets; they're like your personal financial GPS, helping you stash cash for adventures and adulting without going broke.

The Foundation: What Are Savings and Sinking Funds Spreadsheets?

Savings and Sinking Funds Spreadsheets are like your financial wizard - they guide you, they protect you, and they ensure that your money works as hard as you do.

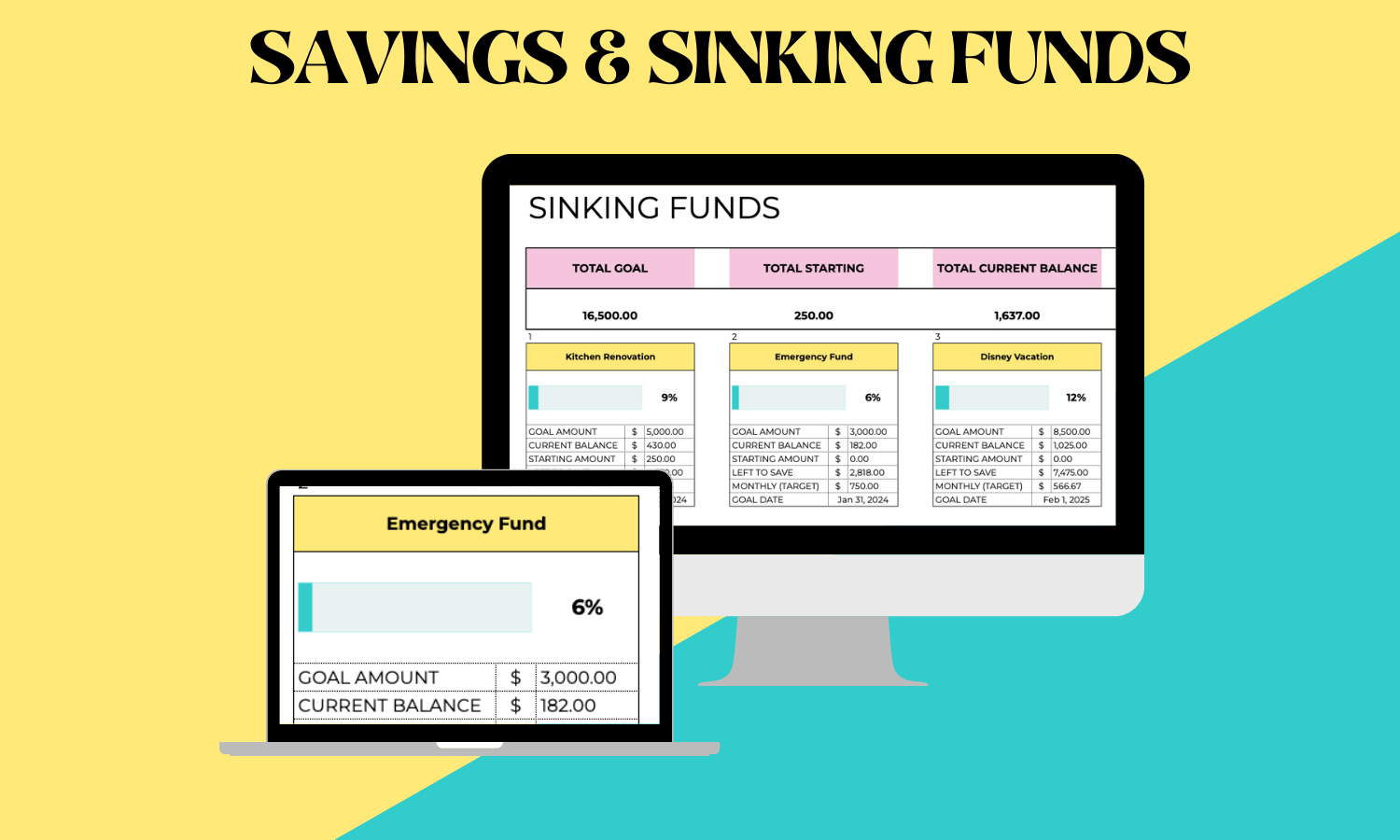

It is a digital tool that helps you allocate, track, and grow your savings for various purposes.

These spreadsheets are designed to allow you to allot specific amounts of money for different savings objectives. Whether it's an emergency fund, a dream vacation, a new car, or even an upcoming wedding, these spreadsheets help you channel your hard-earned money where it needs to go.

Why Savings and Sinking Funds Spreadsheets are a Game-Changer

Organization and Clarity: The first step in managing your finances effectively is to get organized. Savings and Sinking Funds Spreadsheets are your digital filing cabinet. They keep your various savings goals in distinct categories, so you always know where your money is allocated.

Preventing Overspending: One of the biggest challenges in personal finance is not overspending. With these spreadsheets, you allocate funds for various purposes, preventing the temptation to dip into your savings for other expenses.

Earning Interest: Not all savings accounts offer the same interest rates. Some are higher, while others are lower. These spreadsheets can help you determine where to allocate your money to earn the most interest, making your savings work harder for you.

Customized Savings Goals: Every individual has unique financial goals. Whether you're saving for a down payment on a house, your child's education, or a dream vacation, these spreadsheets allow you to customize your savings goals for your unique life circumstances.

You may also like:

Benefits of Savings and Sinking Funds Spreadsheets

Now that we understand why these spreadsheets are so essential, let's dive into the multitude of benefits they offer:

1. Financial Clarity: These spreadsheets provide a clear picture of your financial goals and the progress you're making toward achieving them.

2. Emergency Preparedness: Having a dedicated emergency fund is crucial for financial security. These spreadsheets help you set aside money for those unexpected life events.

3. Prevents Impulse Spending: When you allocate money for specific purposes, you're less likely to spend it on something else. This helps control impulse spending and keeps you on track with your savings goals.

4. Interest Optimization: You can allocate your funds to savings accounts or investments that offer the best interest rates, maximizing your earnings over time.

5. Customization: Tailor your spreadsheet to match your financial objectives, whether that's saving for a home, retirement, education, or even that dream luxury watch.

These Savings and Sinking Funds Spreadsheets are your keys to financial security and peace of mind.

Whether you're just starting your financial journey or are a seasoned saver looking to enhance your strategy, these spreadsheets are your steadfast allies, guiding you toward financial success.

Ready to take control of your finances in 2025? Our FREE Budget Binder includes 85+ printable pages with debt trackers, savings goals, monthly budgets, and more. These proven tools have helped thousands get out of debt and build savings. Download now and transform your financial future!